FHFA Retreats from DTI Surcharge on Fannie & Freddie Mortgages in Positive Move for Lenders, Housing Credit; Meanwhile Broader Pricing Changes Prompt Confusion & Stir Old Debates Over Enterprises’ Role Ahead of Hearings Wednesday and Next Week.

The Federal Housing Finance Agency (FHFA) last Wednesday (May 10) rescinded a previously delayed surcharge on mortgages with higher debt-to-income (DTI) ratios that was set to go into effect August 1, and pledged additional transparency into the process of setting the Enterprises single-family guarantees fees and to take public input with a formal RFI to follow – which they released this afternoon here.

Other changes to the Fannie Mae and Freddie Mac’s pricing grids announced in January of this year went into effect May 1 and remain in place – all part of broader pricing review that began in late 2021.

The rescission of the DTI surcharge is a win for mortgage lenders who faced considerable operational and compliance/liability challenges with the plan. More highly indebted prospective borrowers also gain by avoiding an increase in their mortgage rates that we estimate would have amounted to 4 to 6 basis points on a 30-year mortgage, assuming the implementation challenges didn’t simply result in lenders pulling back from these borrowers. For the Enterprises, the move leaves a revenue hole that may still need to be addressed by other future adjustments to their pricing scheme assuming FHFA seeks to maintain a consistent target rate of return.

The removal of the DTI element addresses what was the biggest concern for the mortgage lending industry, however, there was also, in parallel, a distinct, late-breaking crescendo of criticism in the two weeks prior to the May 1 implementation of a new risk-based pricing matrix, some of it based on errant reporting or lacking critical nuances, that may have left observers even more confused about what was happening, why, and where things stand now with what is fair to describe as a fairly complex and esoteric policy. However, those critiques nonetheless raise fundamental questions about risk taking and cross-subsidization in two companies that remain taxpayer-backed and under government control after nearly 15 years of conservatorship and may serve to enliven the debate over reform after two years in which that debate has been mostly dormant.

This note aspires to recap what has transpired in simple terms and provide what we hope to be additional helpful context and commentary ahead of hearings scheduled this week and next, where we expect the pricing changes will feature prominently.

FHFA Pricing Review and Resulting Proposed Changes In Brief.

FHFA announced in November 2021 their intention to undertake a GSE pricing review to “update the current pricing framework to increase support for core mission borrowers, while ensuring a level playing field for small and large sellers, fostering capital accumulation, and achieving viable returns on capital.” From the beginning, our expectation was that FHFA under Director Thompson would likely move to modestly flatten their risk-based upfront pricing grids introduced after the global financial crisis but would resist pressure to dispose of risk-based pricing altogether. This is essentially where Director Thompson landed.

Through three separate announcements between January 2022 and January 2023 (which we recount in an appendix attached to our broader note), FHFA pieced together what we think are most readily grasped as essentially four categories of changes:

1. First, they increased LLPAs for certain mission-tenuous borrowers (i.e. loans for which the policy justification for taxpayer support/backing through the Enterprises has traditionally been seen as weakest), specifically high-balance mortgages, second homes, & cash-out refinances;

2. Second, they eliminated LLPAs for approximately 20% of agency borrowers viewed as “core mission,” including first-time, low-income, or underserved communities, which it is worth keeping in mind are not necessarily identified by their FICO scores or synonymous with greater risk (i.e. you can have first time or low income buyers with very good credit histories and scores, and high income buyers poorer credit histories and scores);

3. Third, they introduced updated pricing grids for the core of the enterprises purchase, refinance, and cash-out refinance borrowers, ostensibly to better align with the 2020 Enterprise Regulatory Capital Framework (ERCF); and

4. Fourth, they had planned to impose a 25-basis point surcharge for certain borrowers with a debt-to-income (DTI) ratio of greater than 40% percent and loan-to-value (LTV) ratios greater than 60%, rising to 37.5 basis points when LTV exceeds 75% (though this has now been rescinded).

The LLPA grids effective as of May 1 are available here. The LLPA grids in place prior to the pricing review and latest change are available here for reference.

So, Where Do Things Stand?

Changes #1-3 above are fully implemented as of May 1. Our sense is that lenders had generally been planning for these changes well ahead of implementation such that they should have already been priced into the market weeks ahead of time.

• We find it doubtful that FHFA will retreat from these changes which have already gone into effect. We nonetheless see these changes as reawakening long-standing debates over the appropriate role, footprint, capitalization, and return profile of the Enterprises in the aggregate and across various loan categories that may inform approaches to pricing changes down the road. Also, we see them bringing a great deal more attention to the nature and degree of cross-subsidization within the grids both prior to and following the recent changes than we have seen in years. This may be interesting as it cuts to heart of the debate over GSE reform and the appropriate role for the Enterprises both in and post-conservatorship.

The DTI surcharge (#4) we felt was likely to be reversed as it now has been – not because DTIs are not correlated with risk (though research has suggested more weakly than one might expect) – but because debts and income are notoriously difficult to document and tend to evolve through the loan manufacturing process, which can be confusing and frustrating to borrowers as it simultaneously increases costs and compliance uncertainty for lenders. This is one reason, in our view, that the CFPB in a separate important rulemaking was persuaded by a broad coalition of lenders and consumer groups to abandon DTI as the hinge-point for its qualified mortgage (QM) definition back in 2020. In any case, FHFA had already in mid-March announced a delay in the effective date to August 1, 2023 and provided some additional enforcement relief through calendar year-end in partial recognition of the challenges. In the meantime, industry marshaled more detailed arguments as to mindsetdc.com 3 why the approach was counterproductive, and ultimately prevailed upon FHFA to withdraw the DTI element altogether.

• There is a wrinkle, however. We suspect the DTI limitation in FHFA’s overall construct was doing significant enough work to maintain a targeted return through the overall pricing scheme, that its elimination may require an offset elsewhere. This could be accomplished a variety of ways, but our point here is that it might mean there could be one more pricing change to come, whether an update to base guarantee fees (g-fees) or tweaks to LLPAs, before the pricing overhaul begun in 2021 is finally and fully complete. We will be watching for signs of any further changes to come in the hearing this week.

We expect all of these changes to continue to come under close scrutiny from Congress, including during a House Financial Services Subcommittee hearing with key stakeholders focused on LLPAs scheduled for this Wednesday, May 17. We also expect the issue to feature prominently amid other issues when we anticipate Director Thompson will appear before the full House Financial Services Committee for an oversight hearing tentatively planned for May 23.

We offer some additional background, context, and thoughts about the broader implications for GSE policy including a recap of FHFA’s announcements and other notable reactions in an appendix to our full note here.

As always, your questions and comments are welcomed.

What Was Up With the Backlash?

• First of all, no one likes a price increase. The price increases imposed on some borrowers at the core of the agency market arguably come at a particularly inopportune time from the perspective of many housing market participants and stakeholders given elevated interest rates and the attendant softening housing market. Mortgage rates have of course risen dramatically since the beginning of 2022, cooling what had been the white-hot housing market provoked by unprecedented monetary and fiscal expansion in response to the pandemic. The pricing changes announced by FHFA are very small in comparison to the effect of interest rates increases triggered by the inflationary environment, so there’s clearly more to the backlash than just that.

• Lender groups tended to remain more focused on the operational challenges created by the DTI element of the pricing changes announced by FHFA, and we suspect they will for the most part continue to be focused there or on any compensating pricing changes to come following its rescission.

• Realtors have argued the price increases are unnecessary and unjustified based on their vision for the future of the Enterprises, which, in contrast to most other bipartisan reform plans to date, envisions essentially two public utilities with regulated rates of return which would in their view imply lower fees.

• Conservatives in Congress were reacting, we think, to something different – albeit some of it based on errant reporting in the media – specifically, the nature and degree of cross-subsidization assumed or implied by the suite of changes made by FHFA generally, and by updates to the LLPA grid in particular. Here, it seems, there has been and is likely to remain, ample opportunities for people to disagree even once the base facts are agreed upon and settled. That is because they inexorably descend into questions regarding what one thinks the appropriate role is for the Enterprises in and out of conservatorship, and it shines a light on the cross-subsidization that was built into GSE pricing before the recent changes and that which continues to exist following the changes, the exact quantification of which is difficult with existing public information.

Some Essential Background & Further Context.

As alluded to already, some of the criticisms leveled at the pricing grid changes in the two weeks leading up to the May 1 implementation date lacked important nuances, including taking account of the role of private mortgage insurance for higher LTV borrowers, as well as the relationship of some of the changes to the Enterprise Regulatory Capital Framework (ECRF) put in place in 2020 under Director Calabria. Further confusing the issue were various stakeholders and other parties attempting to hijack an active debate over the specific calibration of upfront fees to hold prices down, advance a particular vision of GSE reform, or even challenge whether risk-based-pricing is appropriate at all.

We offer the following context on a few of the key issues that got lost in one or more of the pieces we have read in recent weeks:

• Taking MI into consideration for >80 LTV. One of the aspects of the new pricing grids that grabbed the attention of some in the media is that when one looks at the updated grid in a vacuum, it appears that a more highly leveraged borrower is charged less than one that puts more money down. This led some to jump to the conclusion that borrowers were being incentivized to take on more debt and risk. Indeed, none other than the Wall Street Journal Editorial Page succumbed to the error, stating that “those who make down payments of 20% on their homes will pay the highest fees.” And that [t]hose payments will then be used to subsidize higher-risk borrowers through lower fees.” If that were true, it would of course justify the swift and substantial reaction it received. What was missed, however, in the opinion piece and in the resulting echo-chamber, is that fees charged by the Enterprises are not the only risk-based fees in the equation when a mortgage is made. The Enterprises are disallowed by charter from acquiring or guaranteeing loans above 80 LTV without the benefit of additional private credit enhancement. This most often comes in the form or private mortgage insurance, by which private companies put their capital at risk to insure the GSEs (and taxpayers by extension) against losses in the event of a default. The cost of this added private guarantee for borrowers lacking a larger downpayment is added to that charged by the GSEs and factored into the overall cost of a mortgage. When one looks at the changes in the GSEs’ LLPA grids with private mortgage insurance factored in, the alleged perverse incentive to put less money down disappears.

• Taking into consideration the 2020 ERCF. Contextually, it is notable that the pricing grids preceding FHFA’s pricing review had been based upon FHFA’s 2018 Conservatorship Capital Framework (CCF) finalized under former Director Mel Watt and had yet to be updated to reflect the Enterprise Regulatory Capital Framework (ECRF) finalized in November of 2020 under Director Calabria. The ERCF increased the quantity and quality of the capital the Enterprises are required to maintain to protect against unexpected losses that result from a failure of some borrowers to make payments in a severe stress scenario. All things equal, these changes were expected to lead to increased prices for agency-backed mortgages in the aggregate (even if some had forgotten this was coming, probably because the effect is small compared to what is going on with market interest rates). Also, a little more granularly, the ERCF instituted some changes that made the rule more risk insensitive as various observers noted at the time. For instance, it established a 20% risk weight floor for single-family mortgage exposures, which, perhaps counterintuitively, according to FHFA’s 2020 Guarantee Fee report released in November 2021, “increase[d] capital [requirements] more significantly for loans with lower credit risk characteristics (e.g., lower LTVs, higher credit scores, lower DTIs) than for loans with higher credit risk characteristics.” The rule also added a riskinsensitive leverage buffer, but it is less clear whether or how this may have influenced pricing after changes to the capital rule adopted by Thompson in 2021 that were fairly narrowly targeted at restoring capital credit for credit risk transfer (CRT) transactions, which enjoyed strong bi-partisan support.

• G-fees, “Profitability Gaps,” and Cross-Subsidy. What constitutes cross-subsidy may to some extent rest in the eye of the beholder. However, there can be little doubt that there was some cross-subsidization going on before the recent pricing changes, and there remains some cross-subsidization now. It is perhaps notable that the Housing & Economic Recovery Act’s Section 1313 states that the principal duties of the FHFA Director shall be to ensure “the operations and activities of each regulated entity foster liquid, efficient, competitive, and resilient national housing finance markets (including activities relating to mortgages on housing for low- and moderate-income families involving a reasonable economic return that may be less than the return earned on other activities).” Reasonable people will disagree about the degree of cross-subsidization that is appropriate in any given circumstances, but few people close to these issues historically would argue it can or necessarily should be eliminated entirely. It is likely, for instance, that purely private mortgage risk takers – be they private mortgage insurers or private label security issuers – include some degree of crosssubsidization in their own pricing for a variety of reasons which likely changes over time in response to elasticity of demand, the macroeconomic environment, and other competitive and risk-management factors. We expect that FHFA’s RFI will tease much of this out. But, in general, Republicans have historically been skeptical of cross-subsidization, and Democrats quicker to support and defend it, even as some of the staunchest advocates for cross-subsidy are not always clear about who, exactly they are aiming to cross-subsidize (e.g. lower income versus higher risk borrowers, which, as noted earlier, should not be conflated). This sets up for a more politically charged hearing over FHFA policy than we have seen in some time.

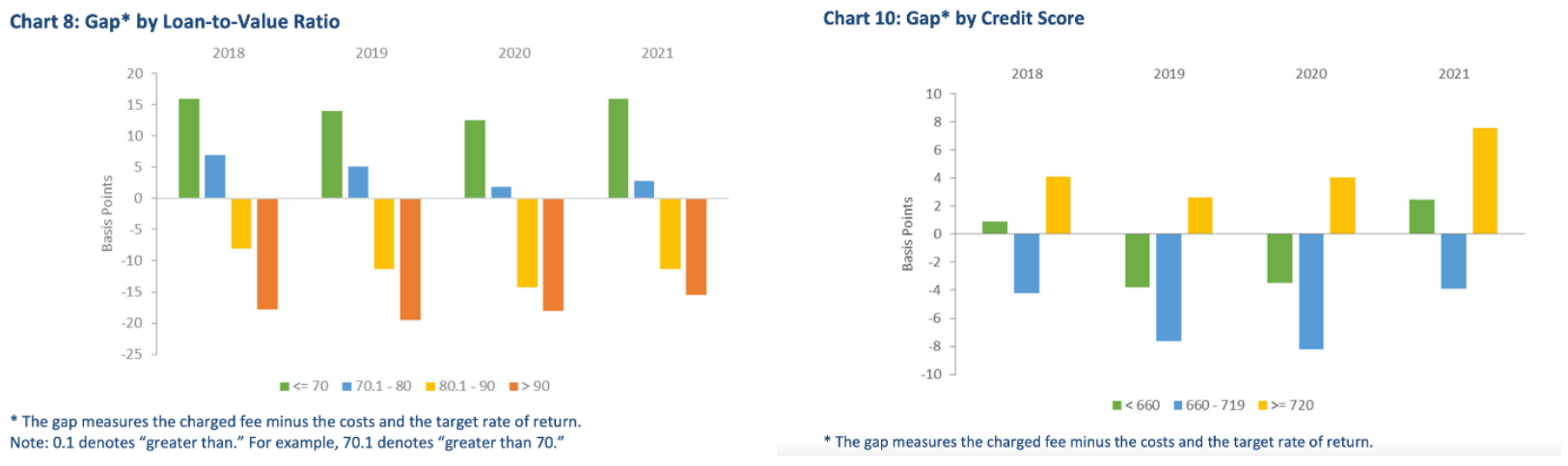

• In any case, good background information can be found in FHFA’s annual Guarantee Fee Reports which include a useful analysis of the Enterprises’ “profitability gaps,” or differences between an Enterprises’ revenue (guarantee fees) received and its estimated total costs which are composed of: (1) expected default costs, (2) the cost of capital held against unexpected losses, (3) general and administrative expenses; and (4) a 10 basis points fee imposed to help pay for the Temporary Payroll Tax Cut Continuation Act of 2011 (TCCA). Of these, their cost of capital is the most significant. If one examines the latest 2021 Guarantee Fee Report released in November 2022, we see that prior to the latest pricing changes, there appears to be a significant amount of cross subsidy from low leverage borrowers (those with higher downpayments) to higher leverage borrowers. Perhaps more interestingly, Chart 10 below indicates that, from 2018 to 2021, the GSEs were arguably overcharging borrowers with high FICOs >720 relative to their risk, but the larger beneficiaries being those with FICO scores in the 660 – 719 band, compared to those <660. Importantly, the annual g-fee reports have yet to analyze gaps compared to the 2020 ERCF, but the Enterprises began to manage their single-family businesses under FHFA’s Enterprise Regulatory Capital Framework (ERCF) in 2022, such that we expect future reports – including the next one anticipated for release in November of this year – will analyze GSE pricing relative to ERCF capital requirements.

• Taking Account of Alternative Executions. It’s helpful to also keep in mind that Fannie and Freddie do not operate in a vacuum. At the low-risk end of the spectrum the GSEs face competition from private label lenders, whether those are individual loans held on bank or other balance sheets or are being packaged into private label securities. Higher risk, and lower-income borrowers often receive better execution in the government-backed market (FHA, VA or USDA) where taxpayers bear a greater portion of the risk versus the conventional market where private credit enhancement for higher LTV loans is involved. And in circumstances when capital market conditions favor it, private label lenders can be expected to cream some of the lowest risk borrowers away from the taxpayer backed GSEs even as there are many policy factors beyond pricing that provide ongoing advantages to the GSEs.

• Limits on Pricing Discretion. As noted above, in the Temporary Payroll Tax Cut Continuation Act of 2011 (TCCA) Congress required the Enterprises to raise guarantee fees by not less than 10 basis points as a means of covering the projected tax revenue losses associated with the payroll tax cut (which was subsequently extended to 2032 by the Infrastructure Investment and Jobs Act to similarly pay for non-mortgage-related policy). Congress also required FHFA in calibrating the increase to “(1) appropriately reflect the risk of loss and the cost of capital allocated to similar assets held by other fully private regulated financial institutions; (2) provide for uniform pricing among lenders; (3) provide for adjustments in pricing based on risk levels; and (4) take into consideration conditions in financial markets.”

Mindset Expectations & Analysis.

There are probably two big policy choices that FHFA has made with recent changes to its pricing framework.

First, they clearly and transparently shifted subsidy away from more mission-tenuous borrowers (expensive homes, second homes, cash-out refinances) to “core mission” borrowers (first-time, lowerincome, or underserved borrowers). While one can debate the validity of this approach, it doesn’t necessarily cleave cleanly along a partisan axis. We don’t see this getting a ton of pushback in the near term and expect the changes to hold, keeping in mind that many of the core-mission borrowers would absent the changes likely wind up going to FHA, VA, or USDA where the taxpayers would face the risk of loss without the benefit of private mortgage insurance. Also, at the low-risk end, Republicans have generally supported a reduced role for Fannie and Freddie in certain missiontenuous categories. Recall, for instance, the Trump administration specifically put language into the Preferred Stock Purchase Agreements (PSPAs) to reduce the GSEs’ footprint in missiontenuous categories such as second homes, and one of the complaints Republicans have had with the Biden administration’s approach to the GSEs is that they’ve suspended those limits (see our September 2021 Mindset Memo). Our point is that what FHFA is doing here with lower risk, mission-tenuous borrowers – at least with regard to second homes – is directionally somewhat aligned with what the previous Republican administration was also aiming to achieve.

Secondly, FHFA is choosing an implied rate of return to target for the Enterprises as they are recapitalizing in conservatorship. Though they have not to our knowledge said explicitly what that rate of return is, we think the FHFA is assuming something in the low double-digits which in turn is likely what they assume would be the required rate of return for a fully private financial institution with a similar size, risk profile, and business opportunity or as statue has it, “reflect[s] the risk of loss and the cost of capital allocated to similar assets held by other fully private regulated financial institutions.” Most Republicans have historically agreed with this requirement and approach to setting a target rate of return, which can be contrasted with some “utility models,” where they might target a lower rate or return and maintain more advantages over private competition.

The flattening of the LLPA grid (Change #3 outlined at the top of the memo), as we understand it, was largely designed to better reflect risks as they are captured in the risk-based capital standards of the ERCF. This is obviously now the hottest topic of ongoing inquiry heading into the hearing this week and beyond. We expect it to bleed into questions as to whether the 2020 ERCF makes sense and how closely pricing should hew to the various risk weights, multipliers, risk-weight floors, and buffers included in that final rule. However, we suspect when it’s all said and done, FHFA is likely to stick to its guns here and do not expect to see a great deal of pushback from stakeholders broadly.

To be clear, the GSEs LLPA grids were risk-based priced before the changes on May 1, and they remain risk-based priced following the recent changes. One can in one sense conclude they are less risk-based priced following the changes that went into effect May 1 on the basis that the slope of the LLPA grid is clearly flatter than it was before. However, one needs more information about actual historical loss experiences and various modeled scenarios into the future to reach a truly informed conclusion about the degree to which prices the Enterprises are charging most accurately reflects their assessed risks for loans with various risk characteristics individually or in the aggregate. Bottom line, just how much cross-subsidization was built into the grids prior to the recent proposed changes and how much is in there now is somewhat opaque and might be something we expect members of the House Financial Services Committee may try to tease out in this week’s hearing and by other means. Ultimately, though, we don’t see FHFA being forced to revisit the grid changes in the near future, with the one possible caveat that they may need to develop an offset for the elimination of the DTI surcharge before this current pricing review is all said and done.

More broadly, we view this episode as a reminder that policymakers and stakeholders ignore the work of GSE reform at considerable risk. What is especially needed in our view is for stakeholders and policymakers to be actively forging some degree of policy consensus and a roadmap to a where a bipartisan, long-run, stable equilibrium for GSE policy is likely to lie. In the absence of this roadmap, as we have noted before, FHFA has to make a myriad decisions week-to-week and month-to-month that can be come unmoored to a clear destination. Moreover, mortgage policy may wind up swinging more wildly from administration to administration and Congress to Congress, which probably is not in the long-term interests of most housing stakeholders or the economy.

It also reminds us how concerned Republicans have become at the prospect that the Enterprises could, or may have already, become, the political playthings of a progressive administration following the Collins Supreme Court decision by which a previously independent FHFA Director may now be subject to removal from office without cause, and thus potentially feel beholden to do the White House’s bidding. This is one reason why we continue to expect the next Republican administration, whether in 2025 or some other timeframe, will likely make ending the conservatorships with or without legislation a key priority in their first term in office, and why there may be some wisdom to stakeholders to begin thinking about the possibility well ahead of that timeframe. Absent work on a consensus plan in the next year or two, which does not currently seem to be immediately forthcoming, we would expect more policy uncertainty and instability in the mortgage market in the meantime and the coming years.

Additional Resources.

• FHFA Request for Input on Enterprises’ Single-Family Pricing Framework (5/15/23) • Housing Policy Council Letter (4/27/23)

• Community Home Lenders Association Letter (4/27/23)

• Mindset Memo: Recapping FHFA’s Recent Proposed Amendments to Enterprise Capital Rule (3/3/23)

• 2021 Guarantee Fee Report (11/16/22)

Appendix A: Recapping FHFAs Pricing Review Announcements to Date.

Recapping each of the key announcements so far in succession:

1. November 17, 2021 – FHFA issued its 2022 Conservatorship Scorecard, which included a directive to, “Update the current pricing framework to increase support for core mission borrowers, while ensuring a level playing field for small and large sellers, fostering capital accumulation, and achieving viable returns on capital.” (See our Mindset Memo)

2. January 5, 2022 – FHFA announced increases in upfront fees for certain high balance and second home loans. Perhaps notably, these came ahead of Director Thompson’s confirmation and seemed timed, in part, to help secure Republican support for her nomination by raising fees on those loans for which the public policy justification for taxpayer backing through the Enterprises was perceived by many Republican’s as the weakest.

3. October 24, 2022 – FHFA announced the elimination of upfront fees for certain first-time homebuyers, low-income borrowers, and underserved communities which FHFA estimated would lead to savings for approximately 20% of agency borrowers, while implementing targeted increases for most cash-out refinance loans. The specific categories on which upfront fees were eliminated included:

• First-time homebuyers at or below 100% of AMI (or 120% of AMI in high-cost areas); • HomeReady and Home Possible loans (Fannie and Freddie’s affordable mortgage programs)

• HFA Advantage and HFA Preferred loans, and

• Single-family loans supporting the Duty-to-Serve program. (See our October 24, 2022 Mindset Memo for additional details).

4. January 19, 2023 – FHFA recalibrated upfront fee matrices for purchase, rate-term refinance, and cash-out refinance loans. Notable changes included a new delineation of credit score and LTV ratio buckets and the inclusion of additional LLPA attributes related to certain borrowers with a DTI ratio above 40 percent. (See our January 19 Mindset Memo for additional details).

• March 15, 2023 – FHFA announced a delay of the effective date of the upfront fee for certain borrowers with a DTI ratio above 40 percent to August 1, 2023 in response to industry feedback on implementation challenges. Lenders will also not be subject to post-purchase price adjustments related to this fee for loans acquired by the Enterprises between August 1, 2023, and December 31, 2023.

• May 10, 2023 – FHFA rescinded the DTI surcharge and promised an RFI to follow.

• May 15, 2023 – FHFA published a Request for Input (RFI) on its single-family pricing framework for Fannie Mae and Freddie Mac.

Recent Dust-Up.

We recount the following for added context on the dust up that occurred in the two weeks preceding implementation of the new pricing grids on May 1, 2023:

• April 16 On April 16, former Obama-era FHA Commissioner gave an interview to the New York Post on the changes, stating, “This was a blatant and significant cut of fees for their highest-risk borrowers and a clear increase in much better credit quality buyers – which just clarified to the world that this move was a pretty significant cross-subsidy pricing change.” We don’t know that there is anything inherently off base in that statement, there are some nuances that may have been lost.

• April 22 – The Wall Street Journal Editorial Board then picked up the story and published a critical piece April 22 on the credit score changes, which raised the profile of the issue in conservative media and with conservative members of Congress and from there quickly took on a life of its own. There was a flurry of activity this past week with numerous prominent and rank-and-file Republican lawmakers – on and off the Committees of jurisdiction – attacking what came to be perceived to be a “tax” on creditworthy borrowers to subsidize those with riskier credit profiles and “social-engineer” the housing market.

• Tuesday, April 25 – House Financial Services Committee Chair McHenry (R-NC) and Housing Subcommittee Chair Davidson (R-OH) sent a letter to FHFA Director Thompson urging the Agency to reverse recent changes to the GSEs’ loan level pricing adjustment (LLPA) structure, which they state “amount to a tax on all creditworthy GSE homebuyers to subsidize borrowers with riskier loans.” Should FHFA fail to reverse the changes, the lawmakers state they are prepared to take action to repeal them legislatively “and reconsider the parameters of FHFA’s authority under statute to mandate any similar pricing changes going forward.”

• Tuesday, April 25 – FHFA Director Thompson issued a statement defending the changes, characterizing the reporting as “a fundamental misunderstanding about the fees charged by the Enterprises and why they were updated,” and pushing back on arguments that changes to the framework are intended to stimulate mortgage demand. She underscored that the changes are intended to “maintain support for purchase borrowers limited by income or wealth, ensure a level playing field for large and small lenders, foster capital accumulation at the Enterprises, and achieve commercially viable returns on capital over time.”

o Thompson refutes reports that higher credit score borrowers are being charged more, stating, “The updated fees, as was true of prior fees, generally increase as credit scores decrease for any given level of down payment….many borrowers with high credit scores or large down payments will see their fees decrease or remain flat.”

o She also argues that the changes do not incentivize borrowers to make lower down payments to benefit from lower fees given borrowers that put down less than 20 percent typically pay mortgage insurance premiums, which increases their total costs.

o Finally, Thompson states that “the targeted elimination of upfront fees for borrowers with lower incomes – not lower credit scores [emphasis hers] – primarily are supported by higher fees on products such as second homes and cash-out refinances.”

• Tuesday, April 25 –The Urban Institute’s Jim Parrot also attempted a general defense of FHFA’s proposal, seeking to put the proposed changes in context in a piece pointing out how the LLPA grids interact with the need for private credit enhancement (usually private mortgage insurance) for loans >80LTV, as was also noted by Thompson in her statement.

• Wednesday, April 26 – At a Senate Banking Committee hearing on housing, Ranking Member Scott (R-SC) and Senators Tillis (R-NC) and Cramer (R-ND) expressed concern with the pending changes (see our Mindset Memo). Scott reiterated those concerns during a Thursday hearing with the credit reporting agency CEOs.

• Wednesday, April 26 – the National Association of Realtors sent a letter to Director Thompson on Wednesday (April 26) expressing concerns with the impact of the credit score recalibration on LLPAs for borrowers with higher credit scores. NAR argues that the change is unnecessary given the profitability of Fannie and Freddie, adding that “the Enterprises have excess capital and revenues built into their pricing and cost structures [under the Enterprise Capital Rule] that they should devote to their duties as market utilities, rather than raising fees on middle-wealth borrowers.”

• Wednesday, April 26 – Reps. Lawler (R-NY), Biggs (R-AZ), and Bice (R-OK) all separately introduced legislation – H.R. 2960, H.R. 2928, and H.R. 2876 – to cancel the proposed changes.

• Thursday, April 27 – Senators Lankford (R-OK), Marshall (R-KS) and Tillis (R-NC) led 15 other Republican Senators in a letter to Director Thompson calling the credit score changes a “shortsighted and counterproductive policy,” placing them among “ a number of policy proposals and changes that seek to social-engineer the US housing market in ways that increase riskiness and promote discrimination,” including the Enterprise Equitable Housing Finance Plans.

• Thursday, April 27 – Parrott and Urban’s Janneke Ratcliffe followed up with a separate piece including a “by the numbers” analysis demonstrating that when mortgage insurance premiums and LLPAs are combined, the cost to the borrower rises with riskiness across the grid.

• Thursday, April 27 – The Housing Policy Council sent a letter to FHFA Director Thompson recommending that FHFA consider an alternative approach to the introduction of the DTI adjuster, such as an alteration to the loan-level pricing or base g-fees.

• Thursday, April 27 – The Community Home Lenders of America sent a letter to FHFA Director Thompson asking for the elimination of the LLPA for Fannie Mae and Freddie Mac loans over 40% DTI, offering support for a 2 basis point across the board LLPA hike if necessary to ending that component.

• Monday, May 1 – Professor Clifford Rossi of the Smith School of Business at the University of Maryland published an additional useful explainer in the form of an opinion piece in HousingWire.

• Wednesday, May 3 – The American Enterprise Institute’s Peter Wallison published a piece critical of the pricing changes.

• Thursday, May 4 – Former FHA Commissioner Ed Golding wrote an opinion piece in HousingWire defending the changes as “consistent with safety and soundness and the charter purposes of the GSEs.”

• Friday, May 5 – Michael Shemi, principal advisor for FHFA’s Division of Housing and Mission Goals, defended the changes in an interview to HousingWire, stating, “The pricing changes FHFA has made since 2020 are intended to improve their ability to reach capital adequacy to meet the update of capital requirements and prevent potential future taxpayer-funded rescue.”

• Monday, May 8 – Senate Banking Committee Ranking Member Scott (R-SC) sent a letter to FHFA Director Thompson expressing concern with the pricing changes and requesting answers to a series of related questions, including that the Agency provide “the expected losses for each category of loans across the Enterprises’ fee matrices.”

• Monday, May 15 – Chris Whalen authored an opinion piece in National Mortgage News arguing that “Sandra Thompson may have oversold the benefits of the LLPA change to the White House. Most low-income borrowers get far better execution in the government loan market, with FHA, VA or USDA,” and separately calling for FHFA to revisit its implementation plan for the upcoming transition to a dual credit score system.